Trading signals are recommendations based on market analysis to buy or sell financial assets. This guide will introduce five new FiduCenter trading signals and explain how you can use them to profit from the market.

New Trading Signals on FiduCenter

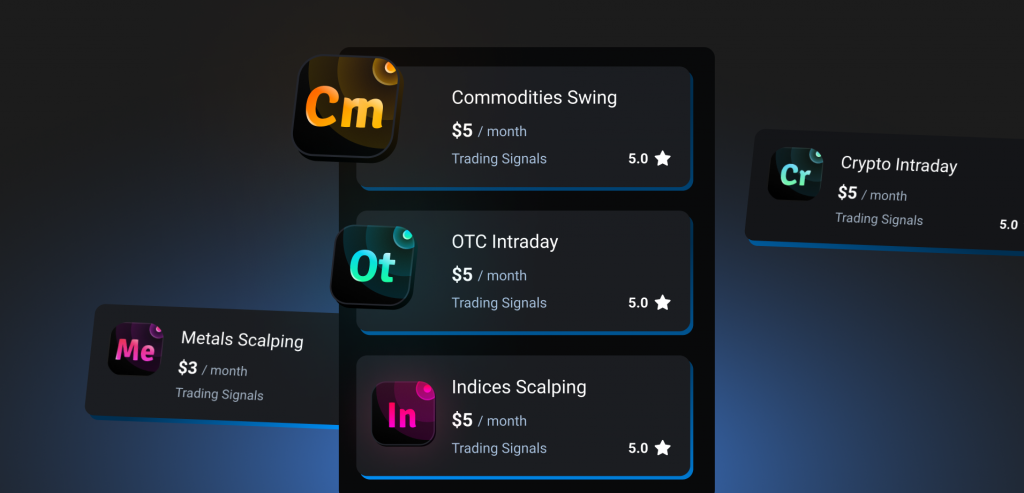

Until recently, you could only use signals for currency pairs as we announced earlier. Today, the FiduCenter team is proud to present five new asset signals available for use. More signals – more profit opportunities!

- Crypto – represented by Bitcoin, Ethereum, and Litecoin. Depending on the selected timeframe, the signal cost starts from $3.

- Metals – includes gold, copper, platinum, and silver. The cost of signals starts from $3.

- OTC – signals are presented for the most popular currency pairs and gold. The cost starts from $2. Please note that OTC is only available in FTT mode.

- Commodities – signals include Brent and natural gas. Their cost starts from $2.

- Indices – represented by ten popular global indices. The cost of signals is from $5.

OTC trading is an excellent choice for those who like to trade on weekends or do not have enough time to trade on weekdays.

| Assets\Timeframes | 1 min, 3 min, 5 min | 10 min, 15 min, 30 min, 60 min | 240 min, day, week, month |

|---|---|---|---|

| Crypto Bitcoin, Ethereum, Litecoin. | Crypto scalping | Crypto intraday | Crypto swing |

| OTC AUD/USD OTC, EUR/USD OTC, GBP/USD OTC, NZD/USD OTC, USD/CAD OTC, USD/CHF OTC, USD/JPY OTC, Gold OTC. | OTC scalping | OTC intraday | OTC swing |

| Metals Gold, Copper, Platinum, Silver. | Metals scalping | Metals intraday | Metals swing |

| Commodities Brent, Natural Gas. | Commodities scalping | Commodities intraday | Commodities swing |

| Indices CAC 40, DAX, Dow Jones, EURO STOXX 50, FTSE 100, Hang Seng Index, NASDAQ, Nikkei 225, S&P 500, RUSSELL 2000. | Indices scalping | Indices intraday | Indices swing |

The use of all the above signals can be carried out on iOS, Android, and the web.

How Do Signals Work?

Let’s remember what trading signals are and how they work.There are many different types of trading signals that are based on mathematical models. FiduCenter uses a multiple linear regression model with predictors.

It is essential to understand that:

- signals are most effective when combined with other technical analysis tools

- signals are the result of technical analysis and are not a call to action

- signals give best results during calm markets when there is no global news that can affect the market as a whole.

You may have a natural question: how accurate are the signals?

However, the answer will not surprise you. FiduCenter signals help analyze the market and, if used correctly, contribute to the conclusion of profitable transactions. You must remember that the accuracy of any forecast cannot be 100%.

The main advantage of trading signals is that they do not need to be configured, and all that is required of you is to decide to use them. Regardless of your status as a trader, you can purchase any signals in the FiduCenter Market.

Which Is Better: Scalping, Intraday, or Swing?

Depending on the trading style of the trader and his goals, trading signals are divided into three categories:

- Scalping is a trading strategy for making short-term transactions from one to five minutes. The essence of scalping is to make many daily transactions to earn a small profit up to a few percent. This category of signals is relevant when using FTT mode.

- Intraday is a transaction that is carried out within one business day. The signals of this group are given at 10, 15, 30, and 60 minutes.

- Swing signals are for 240 minutes, one day, one week, and one month implying trend trading. Swing signals are relevant for Stocks and Forex modes.

With proper use, any of these categories can bring profit to the trader, but choose trading signals according to your personal preferences and trading strategy.

Which Signals Should I Choose?

As mentioned earlier, FiduCenter signals will greatly facilitate your trading, but the accuracy of the forecast can’t always be absolute.

It is essential to know the proper trading signal that would satisfy the profitability, risk, and activity criteria of the trader. Regardless of the assets, be it metals, commodities, or indices, scalping requires skill and is suitable for professional traders.

However, both professionals and beginners prefer intraday trading signals. Traders who prefer volatile assets prefer to trade crypto and commodities. For the purpose of stable income, beginners may want to choose to trade indices and metals.

Any world events influence swing signals, which are known to be difficult to predict. A sudden statement by a politician can instantly change the long-term trend.

Trading strategies are part of success. It is evident that each trader is solely responsible for their actions and chooses trading signals based on their trading strategy.

How to Use Signals

Follow a few simple instructions to search and activate trading signals.

Here is how:

- Select the Trading Signals item located on the Help tab.

- Click Accept and Continue the customer agreement.

- In the top section of the following menu, select one of the three types of trading signals: Scalping, Intraday, or Swing.

- In the Active Signals section at the bottom, you will see the history of the signals, and that the signal is generated once in a certain period of time. For example, for a 1 minute signal, this is once a minute.

- After entering the list of signals and selecting the desired signal, tap Use a Signal.

- To open a trading transaction, set the amount and follow the highlighted recommendation of the trading signal.